Illinois Car Lease Tax . lease tax frequently asked questions starting january 1, 2015, the illinois department of revenue (idor) will change. illinois enacted a budget bill hb 4951 that amends the taxation of tangible personal property leases, prohibits interchange fees. In new jersey, you have a choice of. in illinois, you will pay monthly taxes as of january 1, 2015 (see illinois car lease tax). this page covers the most important aspects of illinois' sales tax with respects to vehicle purchases. Conditional sales and true leases. i’m trying to get a grip on illinois lease tax. As of 1/1/2015, the tax should be only on the lease cost. for illinois sales tax purposes, there are two types of leasing situations:

from opendocs.com

Conditional sales and true leases. In new jersey, you have a choice of. in illinois, you will pay monthly taxes as of january 1, 2015 (see illinois car lease tax). this page covers the most important aspects of illinois' sales tax with respects to vehicle purchases. As of 1/1/2015, the tax should be only on the lease cost. i’m trying to get a grip on illinois lease tax. for illinois sales tax purposes, there are two types of leasing situations: lease tax frequently asked questions starting january 1, 2015, the illinois department of revenue (idor) will change. illinois enacted a budget bill hb 4951 that amends the taxation of tangible personal property leases, prohibits interchange fees.

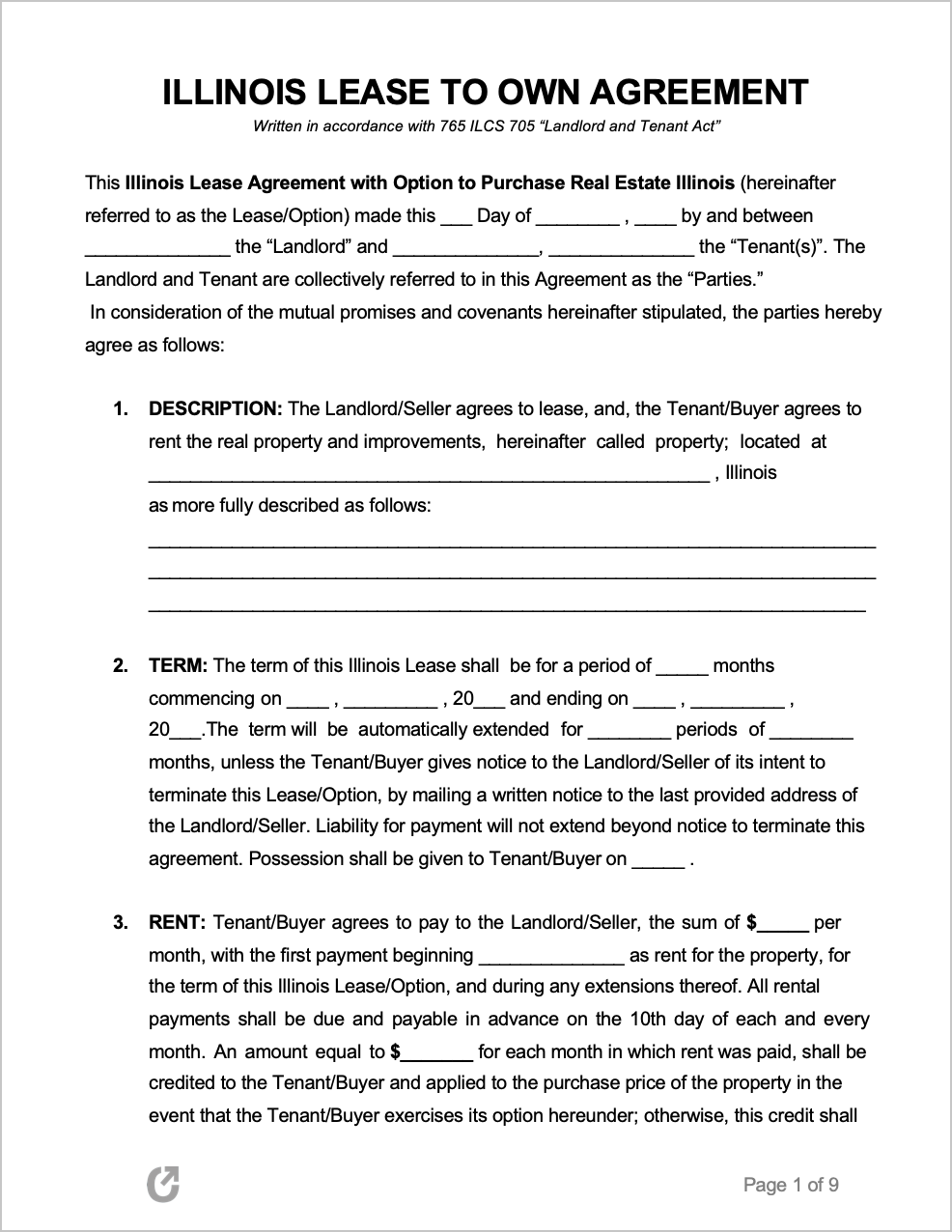

Free Illinois Lease to Own Agreement PDF WORD

Illinois Car Lease Tax illinois enacted a budget bill hb 4951 that amends the taxation of tangible personal property leases, prohibits interchange fees. this page covers the most important aspects of illinois' sales tax with respects to vehicle purchases. i’m trying to get a grip on illinois lease tax. In new jersey, you have a choice of. lease tax frequently asked questions starting january 1, 2015, the illinois department of revenue (idor) will change. for illinois sales tax purposes, there are two types of leasing situations: As of 1/1/2015, the tax should be only on the lease cost. in illinois, you will pay monthly taxes as of january 1, 2015 (see illinois car lease tax). Conditional sales and true leases. illinois enacted a budget bill hb 4951 that amends the taxation of tangible personal property leases, prohibits interchange fees.

From www.insidecarguys.com

Do You Pay Taxes On A Leased Car? Inside Car Guys Illinois Car Lease Tax for illinois sales tax purposes, there are two types of leasing situations: lease tax frequently asked questions starting january 1, 2015, the illinois department of revenue (idor) will change. As of 1/1/2015, the tax should be only on the lease cost. in illinois, you will pay monthly taxes as of january 1, 2015 (see illinois car lease. Illinois Car Lease Tax.

From www.sampletemplates.com

7+ Sample Vehicle Lease Agreement Templates Samples, Examples Illinois Car Lease Tax lease tax frequently asked questions starting january 1, 2015, the illinois department of revenue (idor) will change. Conditional sales and true leases. in illinois, you will pay monthly taxes as of january 1, 2015 (see illinois car lease tax). for illinois sales tax purposes, there are two types of leasing situations: illinois enacted a budget bill. Illinois Car Lease Tax.

From blog.taxact.com

Is It Better to Buy or Lease a Car? TaxAct Blog Illinois Car Lease Tax in illinois, you will pay monthly taxes as of january 1, 2015 (see illinois car lease tax). Conditional sales and true leases. this page covers the most important aspects of illinois' sales tax with respects to vehicle purchases. illinois enacted a budget bill hb 4951 that amends the taxation of tangible personal property leases, prohibits interchange fees.. Illinois Car Lease Tax.

From andromachewtommy.pages.dev

Illinois Car Sales Tax 2024 Ora Birgitta Illinois Car Lease Tax i’m trying to get a grip on illinois lease tax. As of 1/1/2015, the tax should be only on the lease cost. illinois enacted a budget bill hb 4951 that amends the taxation of tangible personal property leases, prohibits interchange fees. this page covers the most important aspects of illinois' sales tax with respects to vehicle purchases.. Illinois Car Lease Tax.

From leaseagreements.com

Free Illinois Lease Agreement Templates (6) PDF WORD RTF Illinois Car Lease Tax this page covers the most important aspects of illinois' sales tax with respects to vehicle purchases. in illinois, you will pay monthly taxes as of january 1, 2015 (see illinois car lease tax). illinois enacted a budget bill hb 4951 that amends the taxation of tangible personal property leases, prohibits interchange fees. i’m trying to get. Illinois Car Lease Tax.

From chryslercapital.com

How to optimize your tax refund when you buy or lease a car Chrysler Illinois Car Lease Tax As of 1/1/2015, the tax should be only on the lease cost. illinois enacted a budget bill hb 4951 that amends the taxation of tangible personal property leases, prohibits interchange fees. i’m trying to get a grip on illinois lease tax. In new jersey, you have a choice of. for illinois sales tax purposes, there are two. Illinois Car Lease Tax.

From criciumanewswebradio.blogspot.com

car lease tax deduction hmrc Jeraldine Will Illinois Car Lease Tax As of 1/1/2015, the tax should be only on the lease cost. in illinois, you will pay monthly taxes as of january 1, 2015 (see illinois car lease tax). illinois enacted a budget bill hb 4951 that amends the taxation of tangible personal property leases, prohibits interchange fees. this page covers the most important aspects of illinois'. Illinois Car Lease Tax.

From blog.saginfotech.com

Tax Benefits on the Car Lease By Employer in India Illinois Car Lease Tax In new jersey, you have a choice of. Conditional sales and true leases. this page covers the most important aspects of illinois' sales tax with respects to vehicle purchases. i’m trying to get a grip on illinois lease tax. illinois enacted a budget bill hb 4951 that amends the taxation of tangible personal property leases, prohibits interchange. Illinois Car Lease Tax.

From www.simplifyem.com

Illinois Lease Agreement Illinois Car Lease Tax i’m trying to get a grip on illinois lease tax. in illinois, you will pay monthly taxes as of january 1, 2015 (see illinois car lease tax). lease tax frequently asked questions starting january 1, 2015, the illinois department of revenue (idor) will change. Conditional sales and true leases. In new jersey, you have a choice of.. Illinois Car Lease Tax.

From opendocs.com

Free Illinois Rental Lease Agreement Templates PDF WORD RTF Illinois Car Lease Tax this page covers the most important aspects of illinois' sales tax with respects to vehicle purchases. illinois enacted a budget bill hb 4951 that amends the taxation of tangible personal property leases, prohibits interchange fees. in illinois, you will pay monthly taxes as of january 1, 2015 (see illinois car lease tax). i’m trying to get. Illinois Car Lease Tax.

From www.carsalerental.com

How To Figure Sales Tax On A Car Car Sale and Rentals Illinois Car Lease Tax i’m trying to get a grip on illinois lease tax. Conditional sales and true leases. in illinois, you will pay monthly taxes as of january 1, 2015 (see illinois car lease tax). for illinois sales tax purposes, there are two types of leasing situations: In new jersey, you have a choice of. As of 1/1/2015, the tax. Illinois Car Lease Tax.

From eforms.com

Free Illinois Commercial Lease Agreement Template PDF Word eForms Illinois Car Lease Tax Conditional sales and true leases. i’m trying to get a grip on illinois lease tax. this page covers the most important aspects of illinois' sales tax with respects to vehicle purchases. As of 1/1/2015, the tax should be only on the lease cost. illinois enacted a budget bill hb 4951 that amends the taxation of tangible personal. Illinois Car Lease Tax.

From trexglobal.com

Illinois Lease Agreement Illinois Car Lease Tax this page covers the most important aspects of illinois' sales tax with respects to vehicle purchases. lease tax frequently asked questions starting january 1, 2015, the illinois department of revenue (idor) will change. in illinois, you will pay monthly taxes as of january 1, 2015 (see illinois car lease tax). i’m trying to get a grip. Illinois Car Lease Tax.

From opendocs.com

Free Illinois Lease to Own Agreement PDF WORD Illinois Car Lease Tax As of 1/1/2015, the tax should be only on the lease cost. lease tax frequently asked questions starting january 1, 2015, the illinois department of revenue (idor) will change. for illinois sales tax purposes, there are two types of leasing situations: In new jersey, you have a choice of. i’m trying to get a grip on illinois. Illinois Car Lease Tax.

From esign.com

Free Illinois Rental Lease Agreement Templates (6) PDF Illinois Car Lease Tax illinois enacted a budget bill hb 4951 that amends the taxation of tangible personal property leases, prohibits interchange fees. for illinois sales tax purposes, there are two types of leasing situations: As of 1/1/2015, the tax should be only on the lease cost. Conditional sales and true leases. this page covers the most important aspects of illinois'. Illinois Car Lease Tax.

From s3.amazonaws.com

Auto loans at bank of america jobs, illinois car lease tax 2015, lease Illinois Car Lease Tax illinois enacted a budget bill hb 4951 that amends the taxation of tangible personal property leases, prohibits interchange fees. for illinois sales tax purposes, there are two types of leasing situations: i’m trying to get a grip on illinois lease tax. Conditional sales and true leases. this page covers the most important aspects of illinois' sales. Illinois Car Lease Tax.

From formspal.com

Free Illinois Lease Agreement Forms IL Rental Templates Illinois Car Lease Tax Conditional sales and true leases. in illinois, you will pay monthly taxes as of january 1, 2015 (see illinois car lease tax). for illinois sales tax purposes, there are two types of leasing situations: this page covers the most important aspects of illinois' sales tax with respects to vehicle purchases. i’m trying to get a grip. Illinois Car Lease Tax.

From freeforms.com

Free Illinois Lease to Own Agreement Form PDF WORD Illinois Car Lease Tax illinois enacted a budget bill hb 4951 that amends the taxation of tangible personal property leases, prohibits interchange fees. Conditional sales and true leases. lease tax frequently asked questions starting january 1, 2015, the illinois department of revenue (idor) will change. As of 1/1/2015, the tax should be only on the lease cost. i’m trying to get. Illinois Car Lease Tax.